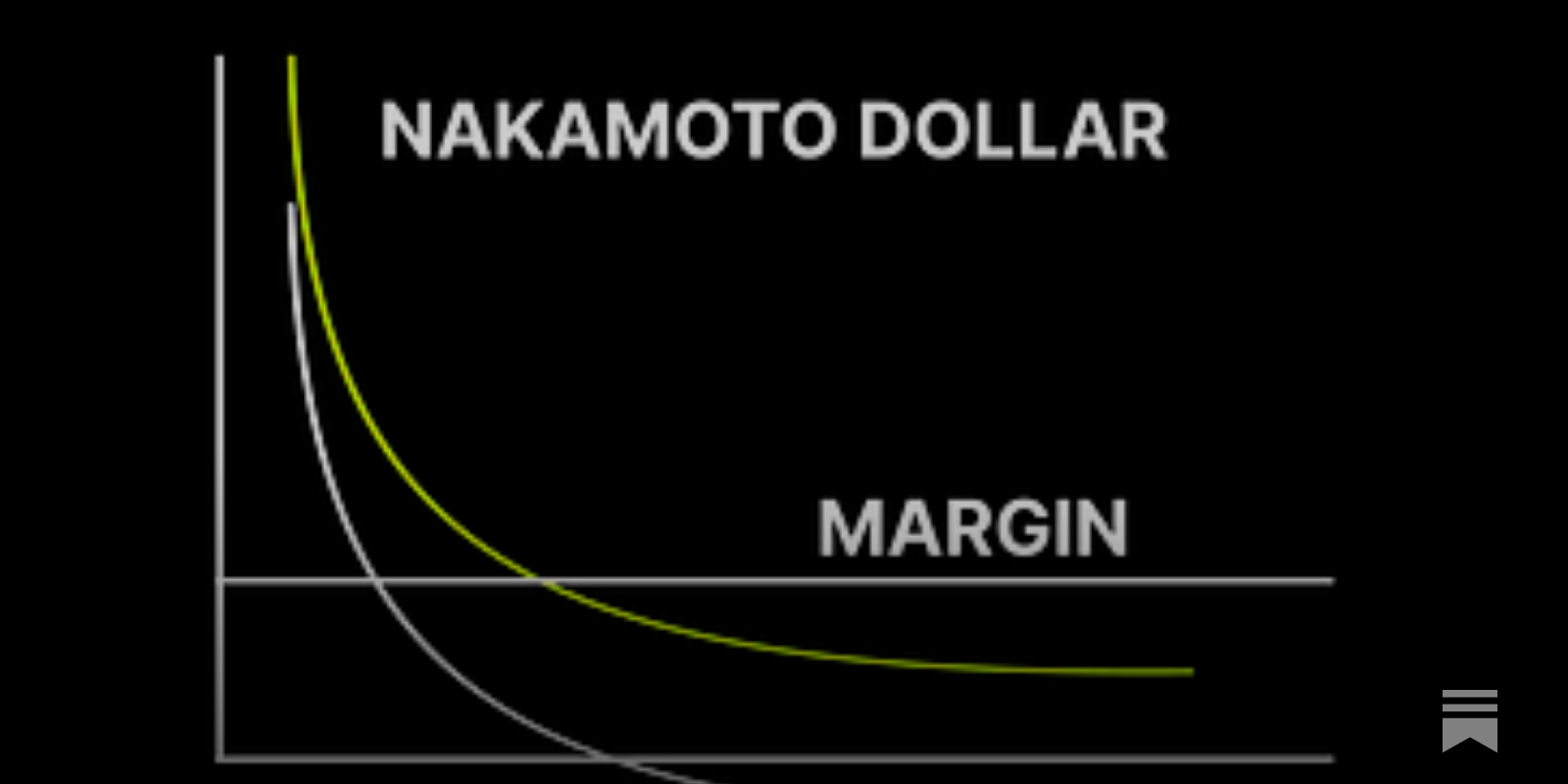

This was super interesting, but I didn‘t get what 1/p represented and why it had something to do with the BTC price. Are perps like collateralized debt positions? Ah - good question. If p is the price of BTC in USD, e.g., 10 BTC = 1 USD then p = 10. 1/p is the inverse so 0.1. Perps are very similar to CDPs in a sense! They ultimately both are margin accounts. This is a theme I will be exploring going forward (and already explored a bit in https://research.auditless.com/p/al-58-synthetix-v3-and-the-margin). Perps are: - more general since they can support leverage - somewhat "fungible" positions since you only have 1 collateral type - because they are fungible and have a market price there is a funding rate which serves as an incentive to ensure that the value of perp tracks the underlying spot asset Fascinating. I feel like a lot of this stuff is, in principle, much simpler than I expected (eg mostly based on margin accounts). I mean, I still don‘t get 1/p, but I have a feeling it‘s not that complex actually | |