Ethereum's North Star (dba.xyz) | |

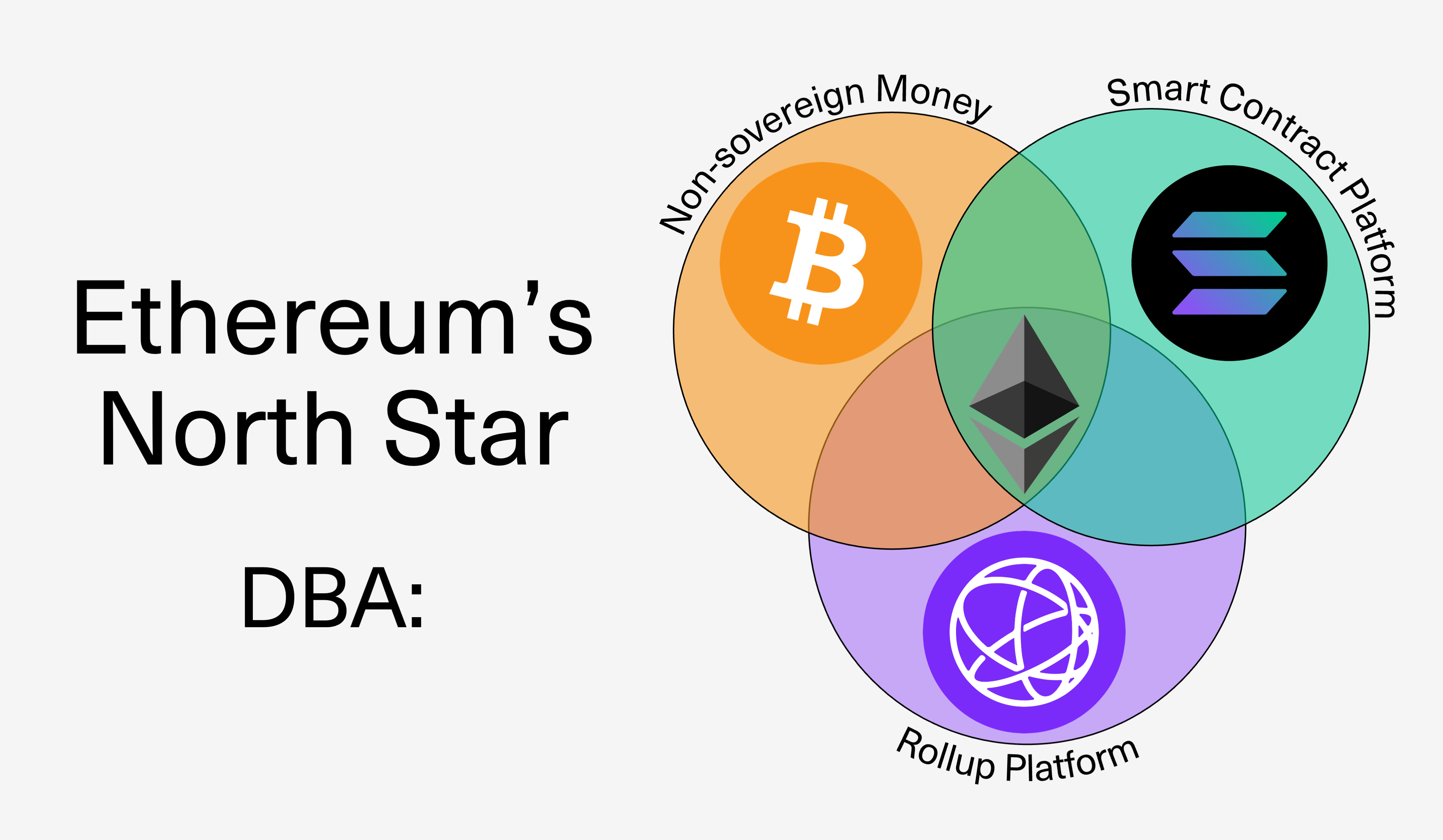

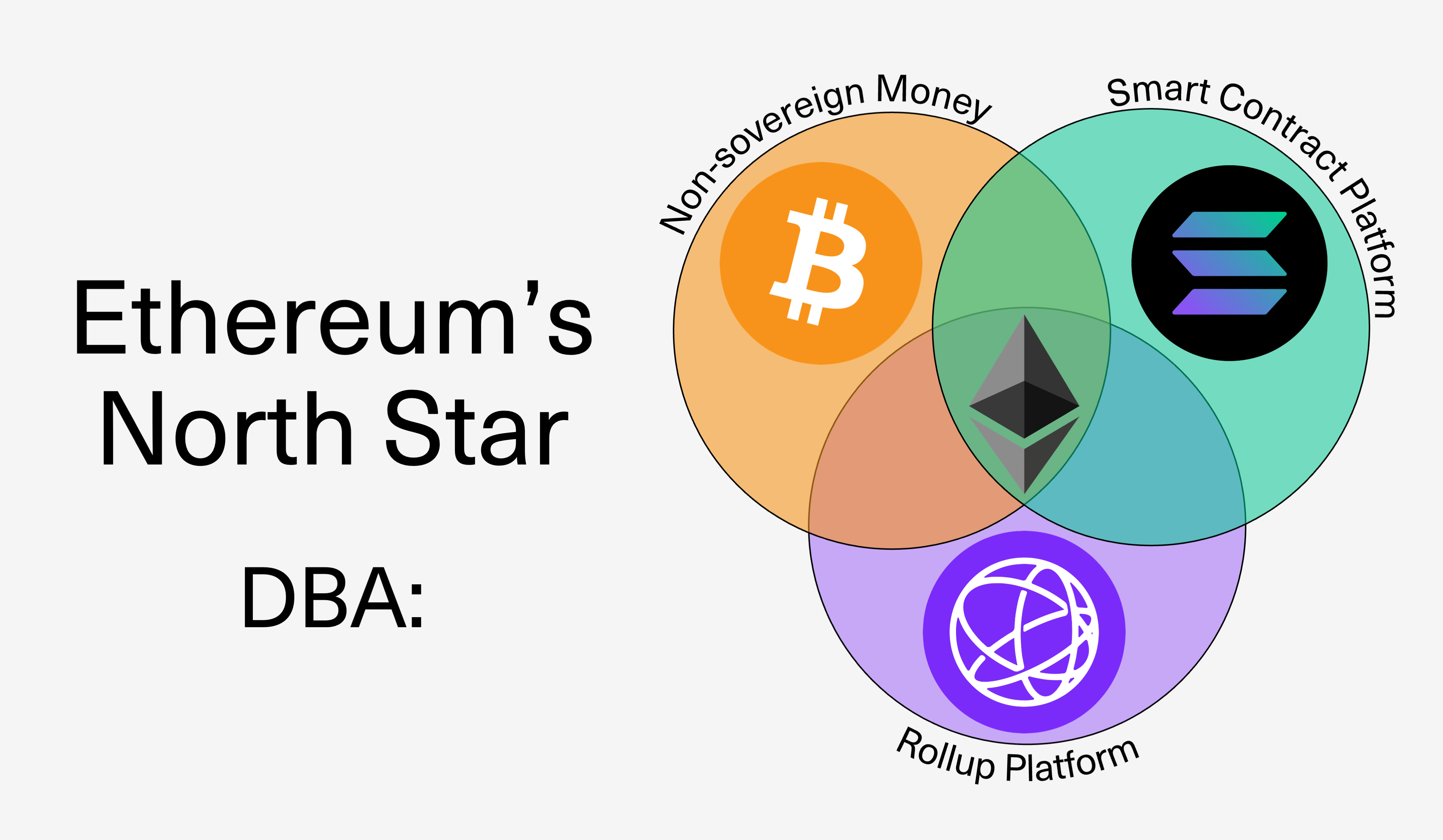

> First of all, we should pay more attention to users and applications Man did I have to read a lot of stuff before I finally reached this one statement which is key. Here‘s my view of things. Many people don‘t like this PoV but IMO Ethereum has hired a very well paid and smart class of „consensus researchers“ to figure out the Merge. The Merge was done well and all these dogmatic people are now looking for ways to stay relevant and not to be fired. Even if you disagree with this take, maybe you agree that a crypto network‘s priorities have changed from compared to 3 years ago. The network which has the most builders wins. Base and Solana‘s growth strategy prove this. And guess what ETH researchers are not attracting builders with their outputs. Meanwhile they are dominating the conversation while the core devs like Peter are taking sabbaticals. Name one person who has reached out to the builders. Beam chain? No single app devs cares about that jazz. We all have the same problems and they revolve around completely different problems that „ETH researchers“ smuggly argue away. Name one item in the Beam chain that serves the most high potential application: Farcaster. The Ethereum media blob group invited Gwart and James to podcast. Some DeFi dinos. But DeFi is going well and is not the only way to grow the network. In fact, if we expose all the retail noobs to memecoin casinos first, guess what their UX is… I feel like a broken record for saying this, but for as long as this professional class of researchers stays in power a pragmatic dev like Anatoly from Solana is going to win. I hope Ethereum people can eventually get this truth into their systems Honestly, the more I read from this post, the more I want to dump my a lot of my Ether because a lot of the claims that are made here is what my rage is made from and why building apps on Ethereum is so hard today. To hear that not even the product people from Aave are getting offers to do user interviews is just crazy. I always thought it was me because I'm not relevant to the EF! Maybe it's also a sign of how much times have changed. In 2021 no one in the space even knew how to develop products, so noone did user interviews. I think we all just build a bunch of stuff and hoped it got traction. But I think the space has matured so much that this isn't sufficient anymore and so now it's actually important we design Ethereum based on what the people need. And honestly, nobody needs yet more opaque consensus upgrades. The people have spoken and they've made it extremely clear WHAT they need. We need defragmentation, better wallet experiences, better tooling. Essentially to grow, we need to give app devs super powers again - which they currently don't have. Honestly, the zk roadmap is cool-ish, but there are much more boring problems that have to be fixed here. E.g. the node RPC endpoints have been neglected for years. The weird data availability sampling and rollups have suddenly made it very hard to copy and deal with data on the network. Dapp devs have to chose a rollup. Native asset issuance on a rollup is senseless as the asset can't be exited. The EIP-4444 topic is a research gift as there are many builders relying on the "data stored forever" invariant etc. Wallet UX is garbage and is becoming worse and worse etc. If you speak to builders, and you don't discuss away their problems "ETH researcher style," you'll find that these are also extremely hard problems to solve that have very little to do with what the current discourse on Bankless is about. I think the whole starting point of the article that there is some sort of competition going on between blockchains a bit childish. Blockchains are building alongside and for their own purposes. If you think there’s competition, you also think that there some sort of winner takes all scenario. That would defeat the whole purpose of blockchains, since the idea is decentralization, so it would be great if there were a lot of blockchains. Winner takes all is old world big tech thinking. I guess you would think that if you think Ethereum is money. I always thought Ethereum was building a world computer supporting a decentralized world. (Still hoping that it’s doing that.) If it would be just money it would be very boring. Like everyone can make a token today ;) … but always good to think about the future of course and where to aim for in the long run! @mishaderidder.eth I think there is real competition between blockchains. They compete for finite resources such as liquidity, users, and developers' attention. And if we look at blockchains as networks, we can see they build their network effects in all these 3 dimensions. And network effects create strong moats and monopoly-like structures (as we saw in web2). The difference between web2 and web3 is that, in Ethereum's case, the user will be 'locked in' in a better system that's run in a decentralized manner, where they have more privacy, ownership, and so on. @timdaub.eth I think two things here can be true. 1) EF needs to focus more on builders. I imagine the EF's POV is: "People who built the Internet didn't have to chat with Netscape and Amazon; they just provided infra, so why would we? We just need to provide fast, secure, and decentralized blockspace and the app devs will figure it out." But I think Ethereum's offering is more complex than the Internet's. First, Ethereum doesn't have a natural monopoly like the Internet. It has competitors like Bitcoin, Solana, and many more. So, devs and users should have a say in the roadmap. Otherwise, they might leave to the competitors. Second, Ethereum's offer is less lightweight than the Internet's "we will connect you, and you have to deal with the rest." There are more things that Ethereum is opinionated about - from block times, through gas fees up to ETH issuance - and it means there are more trade-offs to consider. And builders need to have a say in debating those trade-offs. Third, I think Ethereum should enshrine more things into the protocol. And that's because we don't want important elements of the stack to be privatized and centralized in the same way it happened in web2. *** If I were to steelman the EF stance, I think they might also be worried about the potential lobbying. If they speak too much with Aave, Uniswap, or Lido, these projects might steer the conversation in a direction that's good for them and not good for their competitors. Or even not good for the network. But even if it was true, it shouldn't justify not talking to them at all. We just need to make a process that will minimize this 'regulatory capture' risk. 2) That being said, we need to continue scaling Ethereum as we already reached the blobs target. Here, Vitalik's roadmap is clear, and we need researchers. Do we need as many as are hired? No idea. @macbudkowski.eth Yes, I of course agree with you on that. And yes, the point is "the user will be 'locked in' in a better system that's run in a decentralized manner, where they have more privacy, ownership, and so on." Rooting for that! It's more also that I'm reacting a bit to the tone of the piece. In the end it is so about economic value and money being the defining factor - there are so much more other values in the world. Just saying. And this idea of digital money being better than gold, like Bitcoin maxis pump BTC is digital gold. Look digital money is great and very handy and it solves a lot of stuff, especially access and easy payments. And you can even envision a different kind of world order if you wish. And it's very important that it's open and you can have ownership. But I sometimes think - maybe that's also because I'm running blockchain nodes - if there is no electricity (and that could also be a weapon), there is no access (and no nodes running - no Ethereum) In that respect like having a physical bar of gold in the basement is much more sound storage of value. (Less maintainance also lol.) I don't know, maybe I just a bit tired of all obsession with value in crypto space. Ha ha. It is all relative to the utility. > In that respect like having a physical bar of gold in the basement is much more sound storage of value. And that‘s not the only difference. The scarcity of Bitcoin is a social consensus of miners. The world‘s gold supply isn‘t. As of now there isn‘t a deterministic method to just generate more gold through coordination, but that does work for generating more BTC! I agree, @mishaderidder.eth. I guess that's because the authors are running a fund, so they have a very money-oriented angle there. Also, "there will be only 21M Bitcoins" is a meme because - as Tim said - it's about coordination. And the more halvings we have, the lower Bitcoin's security budget, which means they might be forced to break the '21M BTC promise' to ensure the network is still safe. | |